RiskSeal Reveals a Study of 6 Million Loan Applications, Proving Digital Credit Scores Reliably Predict Default Risk

MCKINNEY, TX / ACCESS Newswire / December 19, 2025 / New research demonstrates how digital footprint data transforms credit risk assessment and expands access for underserved borrowers.

RiskSeal, a global alternative credit data provider, released the results of a large study that analyzed 6.1 million consumer applications from seven fintechs in Mexico.

The research shows strong evidence that digital credit scores built based on borrowers' digital footprint can reliably predict default risk, even when traditional credit data is limited.

The study confirms a clear pattern: default rates drop steadily as digital credit scores rise. This is a major insight for fintechs that want to serve emerging markets and underbanked borrowers more safely.

The findings also highlight how RiskSeal's Digital Credit Score offers a new, data-driven way to assess borrower reliability. It works alongside credit bureau reports to help lenders lower risk and expand credit access.

Setting a New Standard: Digital Scoring as a Predictive Risk Signal

To evaluate whether digital credit scores can reliably predict repayment behavior, RiskSeal partnered with three microfinance lenders, three BNPL providers, and one neobank.

Each of the 6.1 million applications was scored at the time of submission using only information available pre-approval.

The results demonstrated:

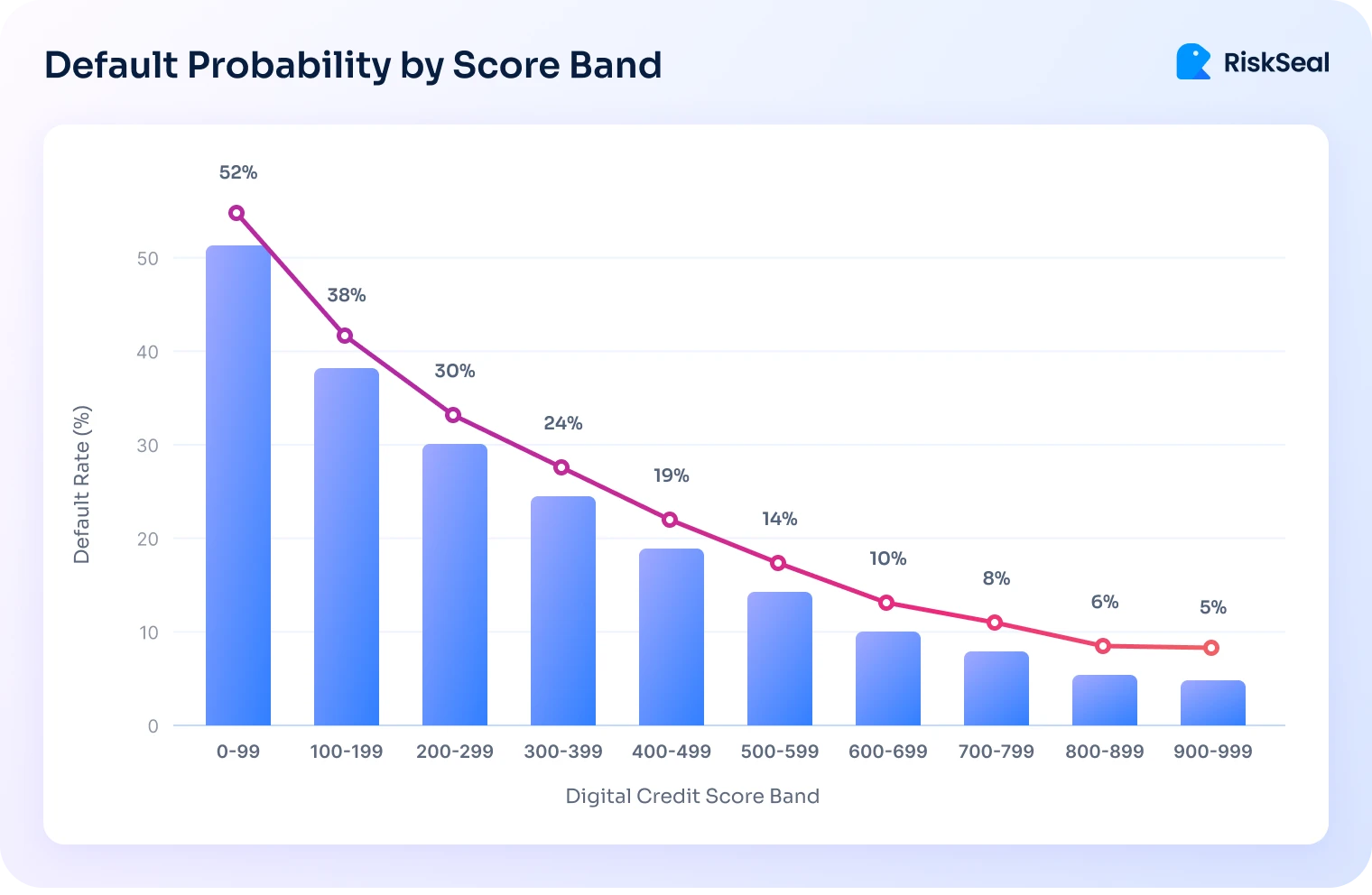

A clear monotonic decline in default rates from 52% in the lowest scoring band (0-99) to 5% among the highest scoring applicants (900-999).

Consistent predictive behavior across all lender types, despite varying borrower segments and credit product offerings.

Improved accuracy when digital and bureau data were combined, reaching an AUC of 0.73, compared to 0.67 for digital-only and 0.69 for bureau-only models.

"Everyday digital signals give lenders a reliable and fair way to understand credit risk," said Artem Lalaiants, CEO and Co-Founder at RiskSeal. "It works in emerging markets, where many people are still denied credit, and in mature markets as well, where teams need to approve good borrowers faster and block bad actors in real time."

Why Mexico Became the Perfect Test Bed for Digital Scoring Innovation

Mexico's rapidly expanding consumer credit landscape made it the perfect environment for this research:

The market reached $323.4 billion in 2024 and is projected to grow to $532.7 billion by 2033.

Over 1,100 fintech companies operate in the country, with nearly 60% targeting underserved borrowers.

Credit bureau files remain thin for millions of consumers, even though Mexico has about 110 million internet users, nearly 80% of the population, according to the LATAM Alternative Credit Data Report.

This combination of fast growth and limited traditional data created a real-world setting to test whether digital scoring can fill longstanding gaps in credit assessment.

How the RiskSeal Digital Credit Score Works

RiskSeal's proprietary Digital Credit Score is built on learnings from 100+ million applications globally. It evaluates the stability, credibility, and consistency of an applicant's digital footprint.

The model analyzes 400+ independent signals, including:

Email: domain quality, age, breach exposure

Phone: carrier type, SIM stability, VoIP indicators

IP & device: proxy detection, VPN/TOR usage

Location & timezone: alignment of declared and observed activity

Digital engagement: eCommerce patterns, subscriptions, web registrations

Security markers: compromised credentials, synthetic identity patterns

Each applicant receives a score between 0 and 999, segmented into risk-based bands. These bands help lenders identify applicants who should be declined, routed for manual review, or fast-tracked for instant approval.

"We don't believe in dumping data on risk teams and hoping something sticks," said Vadim Ilyasov, CTO and Co-Founder at RiskSeal. "We use only the digital signals that consistently predict real repayment behavior. That way, underwriting becomes quicker and more accurate, without the extra noise or workflow headaches."

Key Findings: Digital Scores Predict Defaults

Across 6.1 million applications, RiskSeal identified a powerful and consistent trend: as digital credit scores increase, the probability of default decreases.

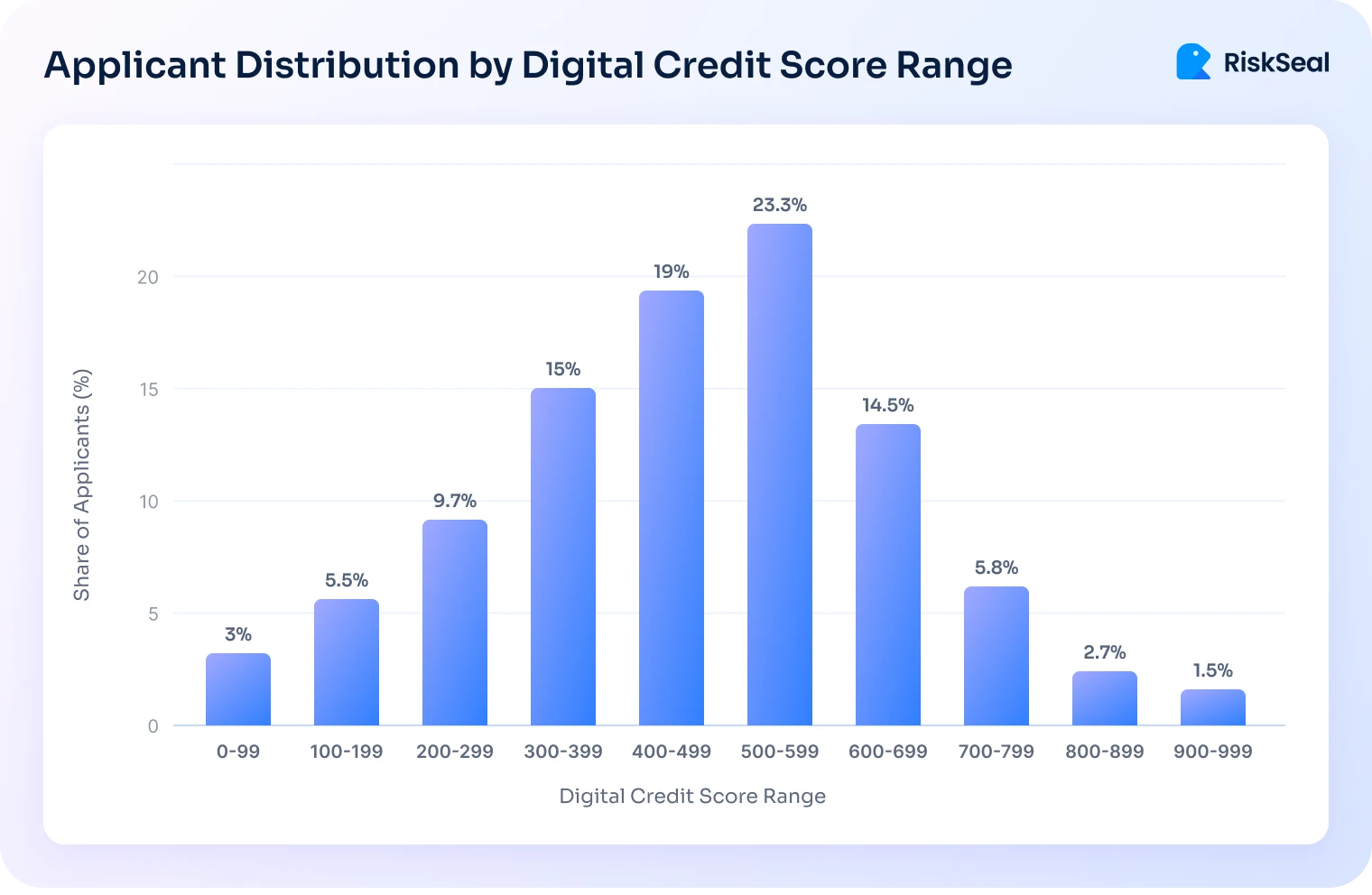

The following chart illustrates the detailed distribution of applicants across different score bands:

Highlights from the analysis:

Bottom band (0-99): 52% default rate

Mid-range (300-599): 14-24% default rates

Top band (900-999): just 5% default rate

This monotonic pattern held steady across all lenders, validating digital scoring as a robust predictive tool.

The chart illustrates how default rates decline consistently as digital credit scores increase, highlighting the relationship between score bands and credit risk:

The research also highlights clear behavioral differences between high- and low-scoring borrowers:

Lower scorers showed fragmented digital activity, unstable contact information, and higher fraud exposure.

Higher scorers demonstrated long-term digital footprint consistency, stable online identities, and verified relationships with trusted web services.

Operational Value: How Lenders Can Use Digital Scores Today

RiskSeal's research outlines how lenders can immediately integrate digital scoring into underwriting:

Enhanced KYC and manual review for scores between 300-499

Automated approvals and faster onboarding for scores above 800

Ongoing monitoring for mid-range applicants to manage evolving credit behavior

This banded approach helps institutions reduce losses, accelerate decisioning, and deliver better customer experiences.

Digital Scores and Traditional Credit Data: Better Together

The study confirms that digital data and bureau data are not substitutes. They are complementary.

When combined, the predictive accuracy improved significantly (AUC 0.73), giving lenders a more inclusive and comprehensive way to understand borrower risk.

"Someone who repaid a loan years ago may look very different today. Digital signals can capture that." continued Artem Lalaiants. "They flag things like new gambling accounts or sudden increases in the volume of loan applications across different lenders. They also identify solid borrowers who aren't well represented in bureaus. Alternative data shows risk where it exists, and stability where traditional data sees nothing."

A Milestone for RiskSeal and the Future of Fair Credit Access

This research represents one of the more extensive analyses of digital credit scoring to date, with millions of applications providing a clear view of how digital-footprint signals perform at scale.

The findings offer lenders solid, data-driven evidence that these signals can reduce uncertainty in high-volume environments and complement traditional credit information.

RiskSeal will continue expanding this work across additional countries and product types to help the industry better understand how digital risk signals function in real-world lending.

About RiskSeal

RiskSeal is a leading provider of alternative data for credit and fraud risk assessment. Our platform analyzes digital footprint signals to help lenders make smarter, faster, and safer decisions. With RiskSeal, financial institutions achieve higher model accuracy, lower defaults, and improved portfolio performance.

Contact Detail:

Company Name: RiskSeal, Inc.

Contact Person: Artem Lalaiants, CEO at RiskSeal, Inc.

Address: 8720 Silverado Trail, McKinney, TX 75070, USA

Phone No.: +1 302-276-8745

Email: [email protected]

Webpage: https://riskseal.io/

SOURCE: RiskSeal, Inc.

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]