Europe Data Center Colocation Market Investment to Reach USD 35.73 Bn by 2030 Amid Rapid Capacity Expansion | Arizton

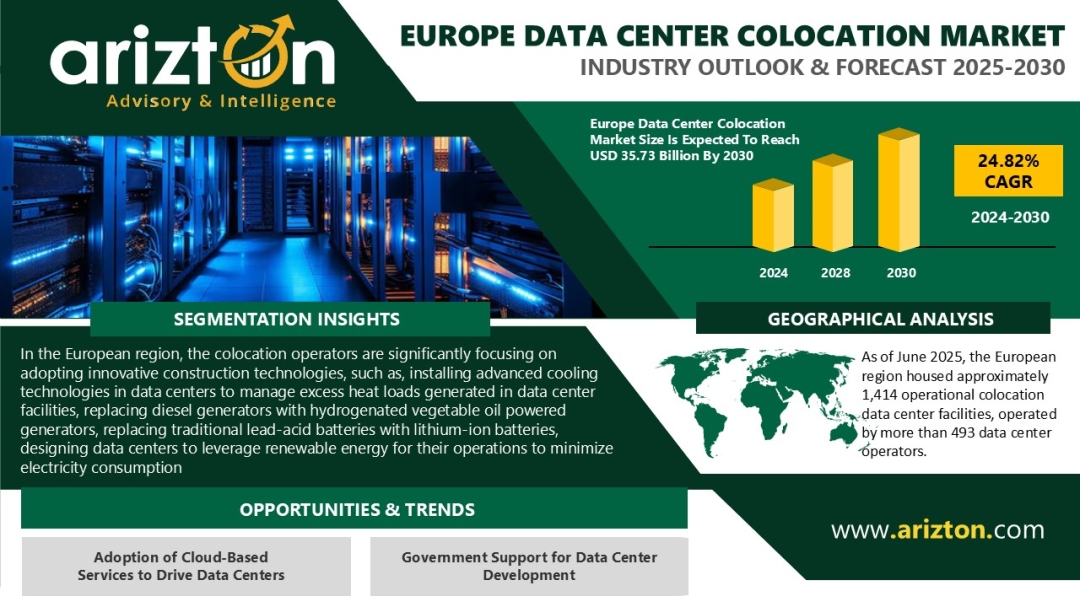

Europe’s data center colocation market is entering a capital-intensive expansion phase. According to Arizton research, market investment stood at USD 9.45 billion and is projected to surge to USD 35.73 billion by 2030, reflecting a robust 24.82% CAGR driven by hyperscale demand, sustainability mandates, and capacity localization across the region.

Explore the Full Market Insights: https://www.arizton.com/market-reports/europe-data-center-colocation-market

Report Summary:

MARKET SIZE BY INVESTMENT 2030: USD 35.73 Billion

MARKET SIZE BY INVESTMENT 2024: USD 9.45 Billion

CAGR - INVESTMENT (2024-2030): 24.82%

MARKET SIZE - COLOCATION REVENUE (2030): USD 37 Billion

MARKET SIZE AREA (2030): 14.79 million sq. feet

POWER CAPACITY (2030): 3,391.4 MW (2030)

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

MARKET SEGMENTATION: Colocation Service, Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Techniques, General Construction, Tier Standards, and Geography

GEOGRAPHICAL ANALYSIS: Western Europe, Nordic, and Central & Eastern European Countries

Europe’s AI Boom Spurs Surge in Investments for AI-Ready Data Centers

Enterprises across Europe, from BFSI and healthcare to retail, transport, manufacturing, e-commerce, and government, are increasingly adopting artificial intelligence to improve efficiency and productivity. This growing AI adoption is driving demand for advanced digital infrastructure, prompting companies like Equinix, Telehouse, Digital Realty, Vantage, Bulk Infrastructure, and STACK Infrastructure to invest heavily in AI-ready data centers. For instance, in February 2025, Data4 partnered with Brookfield Infrastructure Partners to expand AI infrastructure in France with a $20.7 billion investment over five years. Similarly, in January 2025, Italian AI company iGenius teamed up with NVIDIA to build an AI-ready data center in Southern Italy with a $102 million investment. As AI adoption continues to rise, demand for high rack-power density, liquid cooling, and other specialized infrastructure is expected to grow, making AI-ready data centers a key part of Europe’s digital transformation.

Increase in 5G Deployments Driving Growth of Edge Data Centers in Europe

Telecommunications providers across Europe are investing heavily in 5G network expansion to deliver ultra-low latency and high-bandwidth connectivity to both enterprises and consumers. In March 2025, Swiss operator Sunrise announced plans to build a standalone 5G network, underlining the growing emphasis on low-latency services. This surge in 5G adoption is driving demand for edge data centers, which process and store data closer to end-users, reducing latency and enhancing performance compared to traditional centralized facilities. As networks expand, the need for localized data processing is set to rise, spurring investments in edge infrastructure across multiple European markets.

Sustainability Becomes a Strategic Differentiator in Europe’s Data Center Market

Sustainability is now a decisive factor shaping investment and expansion strategies across Europe’s data center market, as operators respond to stricter environmental regulations and rising energy costs. With data centers accounting for a growing share of power consumption, providers are accelerating efforts around energy efficiency, carbon reduction, and renewable integration to align with national climate-neutrality goals. Colocation operators are increasingly adopting advanced cooling systems, water-efficient designs, and alternative power sources to strengthen ESG compliance while improving long-term operating economics. This shift is reflected in recent initiatives such as Digital Realty’s partnership with Ridge Energy to secure 5.1 MW of solar capacity, and Verne’s move to replace diesel generators with Hydrogenated Vegetable Oil systems at its London facility, cutting emissions by nearly 90%. This highlight how green infrastructure is directly influencing investment, tenant demand, and market growth across Europe.

Rise of District Heating Strengthens Sustainability Economics of European Data Centers

The District heating is gaining traction as a strategic sustainability solution in Europe’s data center market, enabling operators to reuse waste heat from IT infrastructure and supply it to local heating networks. With district heating systems capable of meeting nearly 50% of Europe’s heat demand by 2050 and around 17,000 systems already in place as of 2025, data centers are increasingly integrating heat-recovery models to improve energy efficiency and reduce carbon emissions. In April 2025, atNorth partnered with Kesko Corporation to supply waste heat from its FIN02 data center in Espoo, reducing annual emissions by around 200 tons. As Europe advances its carbon-neutral objectives, district heating is emerging as a key driver of sustainable data center development, supporting lower operating costs and localized energy optimization.

Request for a free sample? here: https://www.arizton.com/market-reports/europe-data-center-colocation-market

Key Data Center Colocation Operators

- 3data Premium Data Centers

- Play Business Solutions

- Aire Networks

- AQ Compute

- Ark Data Centres

- Artnet

- Aruba SpA

- Atlantic Data Infrastructure

- AtlasEdge

- Atman

- atNorth

- Atomdata

- Bahnhof

- Beyond.pl

- Blue

- Bulk Infrastructure

- China Mobile International

- CloudHQ

- Colt Data Centre Services

- CyrusOne

- Data4

- DataCenter United

- Datum Datacentres

- DENV-R

- Digital Realty

- EcoDataCenter

- EdgeConneX

- Equinix

- Global Switch

- Global Technical Realty

- Green

- Green Mountain

- Serverfarm

- Iron Mountain

- IXcellerate

- K2 STRATEGIC

- Kao Data

- Keppel Data Centres

- LCL Data Centers

- Linxdatacenter

- maincubes SECURE DATACENTERS

- MERLIN Properties

- MTS

- Nation Data Center

- Nehos

- Nscale

- NTT DATA

- OpCore

- Penta Infra

- PHOCEA DC

- Polar

- Pure Data Centres Group

- QTS Data Centers

- Rostelecom

- Selectel

- STACK Infrastructure

- STACKIT

- STORESPEED

- Switch

- Telehouse

- Thésée DataCenter

- Vantage Data Centers

- VIRTUS Data Centres

- Yondr Group

New Entrants

- ECO-LocaXion

- 1911 Data Centers

- ACS Group

- Ada Infrastructure

- SWI Group

- Apatura

- Apto

- Arcem

- Aroundtown SA

- Art Data Centres

- Asia Pacific Land (APL)

- AVAIO Digital Partners

- Blue Star

- Box2Bit

- Brookfield

- Caineal LLP

- Corscale Data Centers

- DAMAC Digital

- DATA CASTLE

- Data Center Partners

- DayOne

- Northtree Investment Management

- DATA for MED

- dataR GmbH

- DC01UK

- Deep Green

- Digital Reef

- Digital Land & Development

- EdgeMode

- EdgeNebula

- Edora

- EID LLP

- Elementica

- Elite UK REIT

- Energia Group

- EngineNode

- G42

- evroc

- BADEN CLOUD

- FCDC Corp

- Form8tion Data Centers

- Goodman

- GreenScale Data Centres

- GREYKITE

- ICADE

- iGenius

- Kevlinx Data Centers

- Compass Datacenters

- Keysource and Namsos DataSenter

- Kennedy Wilson

- Latos Data Centres

- Liberum Navitas

- Lidl

- Link Park Heathrow

- Mainova WebHouse

- Mistral AI

- Edged

- Greystoke

- NETHITS IT SOLUTIONS

- Norwich Research Park

- Nostrum Group

- Origin Energy Services & Woodland Investment Management

- Panattoni

- PATRIZIA SE

- PGIM Real Estate

- Polarnode

- Portland Trust

- Prime Data Centers

- Prologis

- Quetta Data Centers

- Red Admiral DC

- Regant

- Salt Ayre Leisure Centre

- Sarenet

- SDC Capital Partners

- SEGRO plc

- Servecentric

- Sesterce

- Solaria Energía y Medio Ambiente

- Stoneshield Capital

- Suomen Energiainsinöörit Oy

- Skygard

- Templus

- Thylander

- Tritax Group

- Valencia Digital Port Connect

- Valore Group

- VDR & Colliers

- VITALI SPA

- WS Computing AS

- X5 Group

- XTX Markets

- Yandex

- Wilton International

- CompassForge Ventures

The Europe Data Center Colocation Market Report Includes

- Colocation Type: Retail Colocation and Wholesale Colocation

- Infrastructure: Electrical Infrastructure, Mechanical Infrastructure, and General Construction

- Electrical Infrastructure: UPS Systems, Generators, Transfer Switches & Switchgear, PDUs, and Other Electrical Infrastructure

- Mechanical Infrastructure: Cooling Systems, Racks, and Other Mechanical Infrastructure

- Cooling Systems: CRAC & CRAH Units, Chiller Units, Cooling Towers, Condensers & Dry Coolers, and Other Cooling Units

- Cooling Techniques: Air-based Cooling and Liquid-based Cooling

- General Construction: Core & Shell Development, Installation & Commissioning Services, Engineering & Building Design, Fire Detection & Suppression, Physical Security, and DCIM/BMS Solutions

- Tier Standard: Tier I & II, Tier III, and Tier IV

- Geography: Western Europe, Nordic, and Central & Eastern European Countries

Related Reports That May Align with Your Business Needs

Europe Data Center Market Landscape 2025–2030

France Data Center Colocation Market – Supply & Demand Analysis 2025-2030

What Key Findings Will Our Research Analysis Reveal?

- How big is the Europe data center colocation market?

- What is the growth rate of the Europe data center colocation market?

- What are the key trends in the Europe data center colocation market?

- How many MW of power capacity is expected to reach the Europe data center colocation market by 2030?

- What is the estimated market size in terms of area in the Europe data center colocation market by 2030?

Why Arizton???????????????????????????????????????????????

100%?Customer Satisfaction??????????????????????????????????????????????

24x7?availability – we are always there when you need us??????????????????????????????????????????????

200+?Fortune 500 Companies trust Arizton's report??????????????????????????????????????????????

80%?of our reports are exclusive and first in the industry??????????????????????????????????????????????

100%?more data and analysis??????????????????????????????????????????????

1500+?reports published till date????????????????????????????

?????????????????

Post-Purchase Benefit??????????????????????????????????????????

- 1hr of free analyst discussion??????????????????????????????????????????

- 10% off on customization???????????????????????

????????????????

About Us:

Founded in 2017, Arizton Advisory & Intelligence delivers data-driven market research and strategic consulting that empowers clients to make informed decisions and drive growth. Combining quantitative and qualitative insights, we provide in-depth analysis across industries including Agriculture, Consumer Goods, Technology, Automotive, Healthcare, Data Centers, and Logistics. Recognized by top-tier media, our expert team transforms complex market data into actionable strategies, helping clients anticipate trends, seize opportunities, and stay ahead of the competition.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/europe-data-center-colocation-market

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Europe Data Center Colocation Market Investment to Reach USD 35.73 Bn by 2030 Amid Rapid Capacity Expansion | Arizton

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]